Times Square Hotel: IHG VOCO

Yieldwink.com is a vertically integrated real estate investment, development, and management firm with a focus on value-add and development opportunities across real estate and business operations.

We are an independent, self-financed team not burdened by debt or beholden to create short-term profits for shareholders. We invest our own money into every deal that appears on the Yieldwink platform. We do not manage deals only to generate fees. This allows our team to be extremely selective about the deals we take on because we have skin in the game, just like you.

When you win, we win. It’s that simple.

About

Access Presentation Here

Access Webinar Here

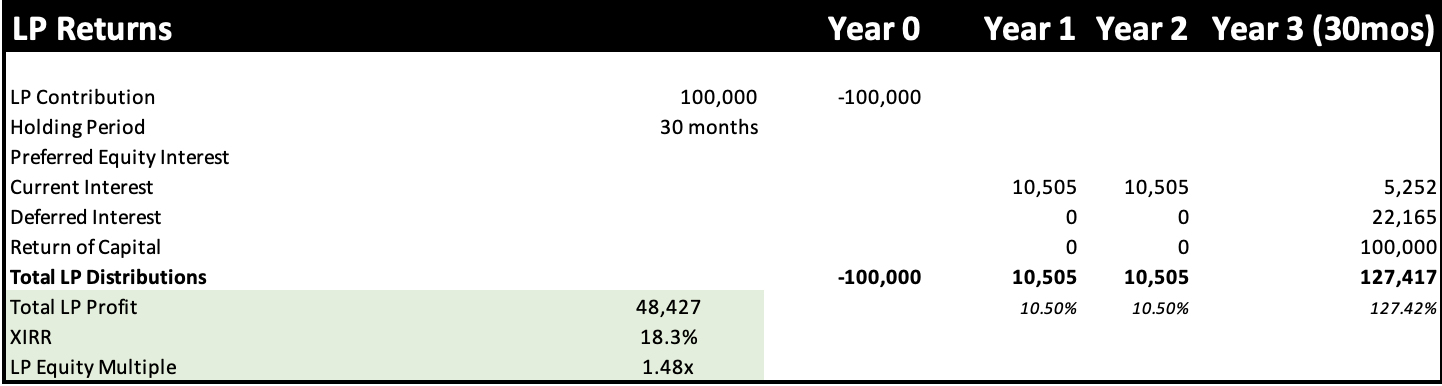

Yieldwink is proud to present a preferred equity investment in a premier Times Square hotel development at 711 7th Ave, New York. The final floor of the VOCO Times Square Hotel was topped off in August 2024, with interior renovations slated for completion by August 2025. The investment distributes an annualized yield of 17.5%, of which 10.5% is paid monthly as current interest and 7% is deferred over the development period.

Key Highlights:

- Agreement Protections: Yieldwink has negotiated priority payment on operational cash flow to cover current fiscal year’s current interest. Signage (billboards) are expected to be up in early 2025, expecting to generate $1.8M - $2M annually. Yieldwink has also placed restrictions on additional debt and new entrants.

- Mitigated Development Risk: The final floor of the VOCO Times Square Hotel was topped off as of August 2024, ahead of schedule, significantly lowering development risk. Please find all risk disclosures in the presentation.

- Limited Supply, High Demand: Due to a 2021 Zoning Amendment, no new hotels in Times Square will be built without a special permit, of which 0 have been issued. Midtown Manhattan occupancy levels remain high.

Yieldwink is raising $3.3 million in preferred equity, a strategic move that enhances project profitability. By reducing the loan amount by $4 million by October 30, 2024, the lender will lower the equity multiple charged on the entirety of the loan from 1.325x to 1.3x, resulting in additional estimated project profits of $3.3 million. Preferred equity investors will be repaid directly after the lender.

The project is forecasted to generate $107.5 million in gross proceeds from the sale, providing significant coverage (21x) of the preferred equity plus interest (see Slide 17 of the presentation). The appraisal, provided by HVS, if available upon request and upon the signing of an NDA.

This Offering is available for accredited investors only.

Please email info@yieldwink.com for more information.

financial summary

- Targeted Average Cash Yield: 17.5%

- Offering Type: Private Credit

- Class: Preferred Equity

- Term: 2Y 6M

- Minimum Investment: $50,000

- Preferred Return: 17.5%

- Goal: $2,700,000 - $3,300,000

Yieldwink

Yieldwink